Polygon ($MATIC): Deep Dive into the largest Ethereum L2

Full Protocol Analysis of Polygon PoS network

Welcome to the 38 newly minted Altcoin Evolutionists who have joined us since last post!

📝 Short form thread on Twitter

Hi internet frens👋 ,

It’s been a while but a lot has happened….

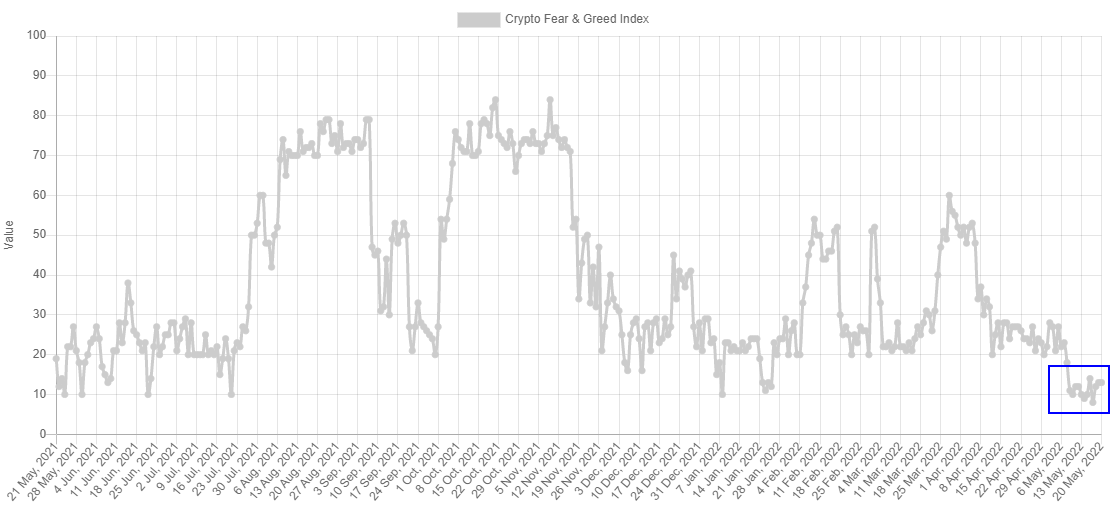

What a couple of week for crypto. I hope everyone is holding up well. In crypto we don’t spend much time scared out of our minds - usually its a mixture of talking our bags up because they aren’t 10x week over week - but we’re right down there now in terms of sentiment.

Quick interlude on Terra ($UST/$LUNA): I am carefully watching how the situation develops with Terra 2.0 and will be doing a post mortem/deep dive soon.

Up until know I have felt confident that alt-L1s would eventually win out but with the collapse in Terra I am beginning to reassess.

This lead me on to looking at L2s and so today we dive in to the largest L2 by market cap Polygon ($MATIC).

Cheers,

Greg

L1/2 Business Model Analysis (BMA) Framework

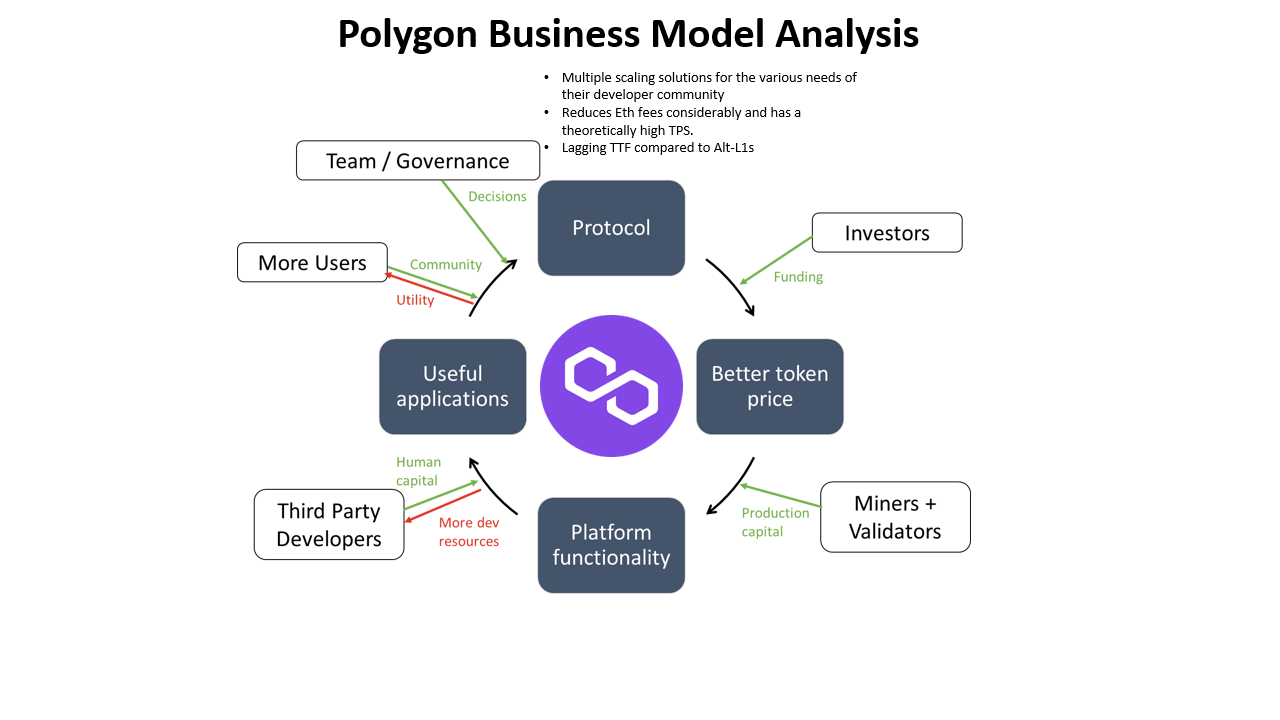

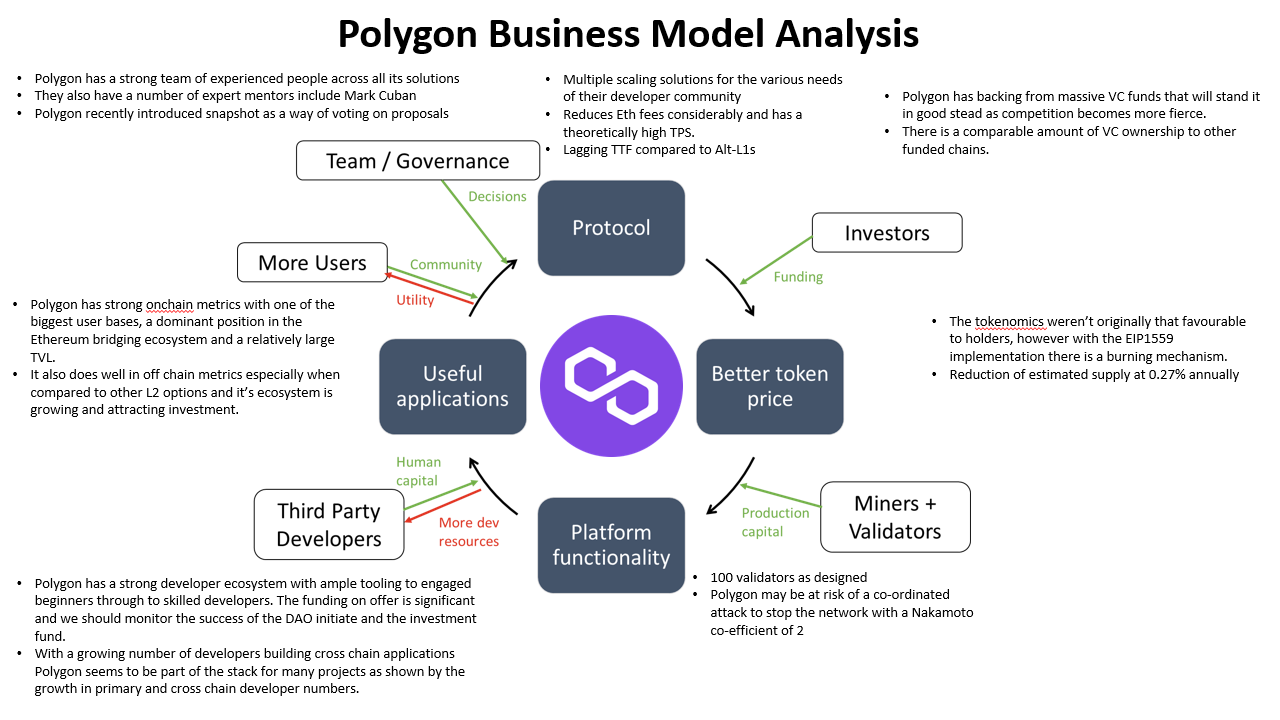

As a quick reminder on how we do these analyses; for any L1/2 technology I adapted a16z’s economic flywheels for crypto framework as shown below:

In principle, what happens here is the team designs, the protocol they input the decisions and stuff, the protocol attracts funding via investors and they give liquidity to the network, which gives a protocol its initial token price. Miners and validators are then attracted to supporting the network because of incentives (tokenomics) which improves the platform functionality because we're now validating blocks.

We now have a working blockchain with nothing being built on it so we turn to developers and try to incentivize them (via resources, grants etc) to build on the blockchain. They put human capital into building DApps and other useful stuff that people want to use attracting users onto the blockchain. These users form the community and eventually help govern the system.

For L2s it is key to look at how many assets have been bought to the network from Ethereum, so we will pay special attention to that.

Polygon ($MATIC): Shapeshifting L2 to the rescue?

a) The promise:

An answer to all Ethereums problems - scalable, fast and cheap transactions coupled with the security of the leading smart contract platform.

b) The reality:

L2s add layer of complexity that will require engineering and UX solutions to integrate and build a seamless technology stack.

c) The rub:

Polygon is a robust ecosystem with solutions that cater to different needs, but one that hasn’t yet reached the promised scale and faces tough competition from both L1s, other L2s and Ethereum itself.

So the question is: can Polygon beat off the competition? Let's find out...

Today we’ll jump into each of the key areas of Polygon covering:

The origins of the protocol

The problem it is trying to tackle and what solutions it is bringing to market

Who are the investors and how do the Tokenomics work

How resistant the network is to attack?

What the developer experience is like

User growth and utility

Team and Future Governance

We’ll then round off with a bull and a bear case for Polygon ($MATIC) and ecosystem.

As always this is just my take, not financial advice - the content herein is for informational purposes only…

Part 1: The Protocol

1a) Background and Vision

Polygon originally launched as the Matic Network to solve the scaling and usability issues of the Ethereum network.

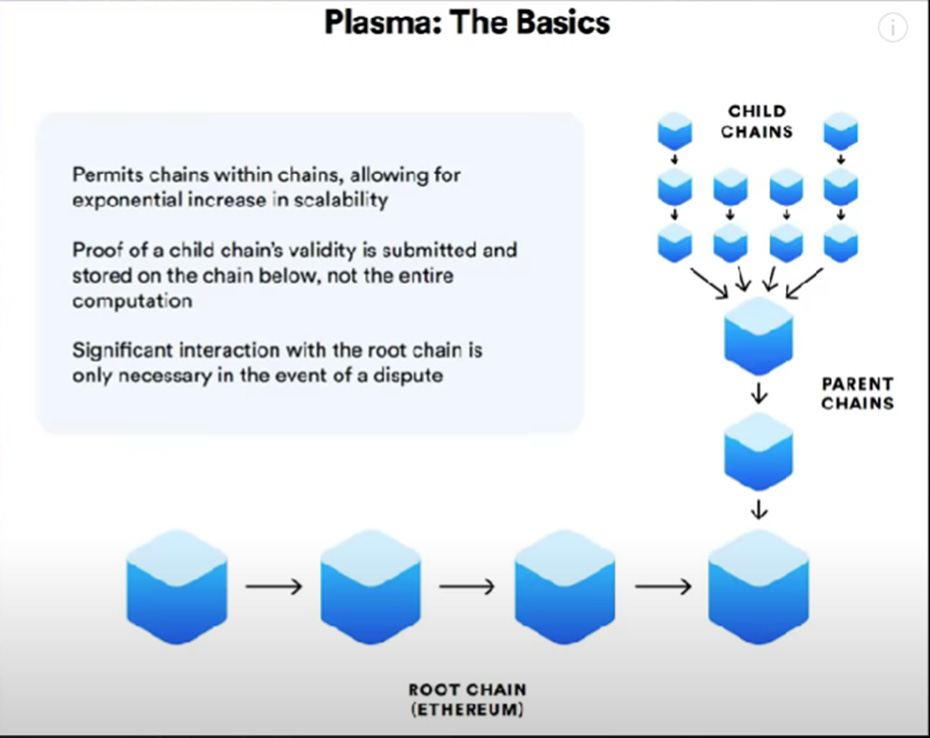

At the time the team used plasma, a type of scaling solution, which became the leading way to scale the network. However since then new solutions have shown promise, which led Matic to rebrand as Polygon and launch multiple scaling products under a single brand with the thesis being that one solution will not be enough.

1b) Scaling Ethereum

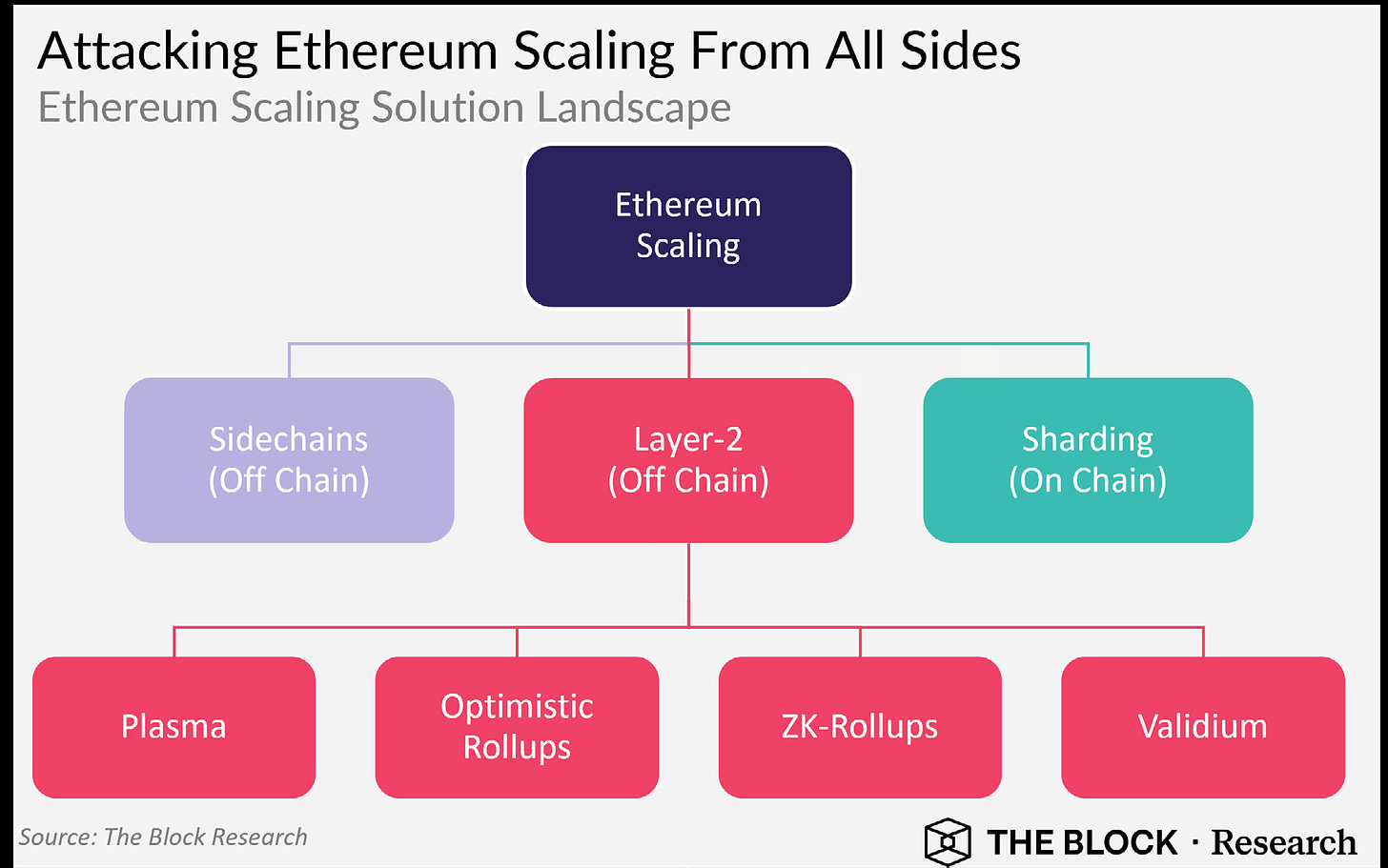

Approaches to scaling Ethereum are varied but the Block categorises them as follows:

Let’s TL;DR at each one (adapted in part from Pedro’s post here):

Sidechains are independent chains that run along side the main chain. They provide their own consensus model and security. To deploy smart contracts sidechains leverage the EVM.

Layer 2’s offload transaction execution from Layer 1’s reducing the congestion on the main chain. They differ from sidechains as they do not assume all transactions executed are valid and do their own proofs to ensure validity.

Plasma effectively creates mini replicas of the main chain. It also has a fraud proof inherent to every child chain. The chains store their data on the main Ethereum chain.

Channels (not above but still an option) e.g Bitcoin’s Lightning Network, are application specific i.e. they can’t be used as a general purpose solution, and require multisig wallets to initiate off chain settlement first then achieve finality onchain after.

Rollups (Optimistic, and zk), which include bundling up, or “rolling up”, and executing a bunch of transactions together at the same time in 1 single transaction.

Validium uses validity proofs (instead of fraud proofs) but data is stored off the main chain

Sharding has had a lot of coverage and there are a number of Alt-L1s that have taken this approach e.g. Near, Harmony.

Sharding is the process of splitting a database horizontally to spread the load. In an Ethereum context, sharding will reduce network congestion and increase transactions per second by creating new chains, known as “shards.” This will also lighten the load for each validator who will no longer be required to process the entirety of all transactions across the network. ~ Ethereum Docs

If you want to learn more about these options this video is a good place to start:

1c) Polygon’s approach

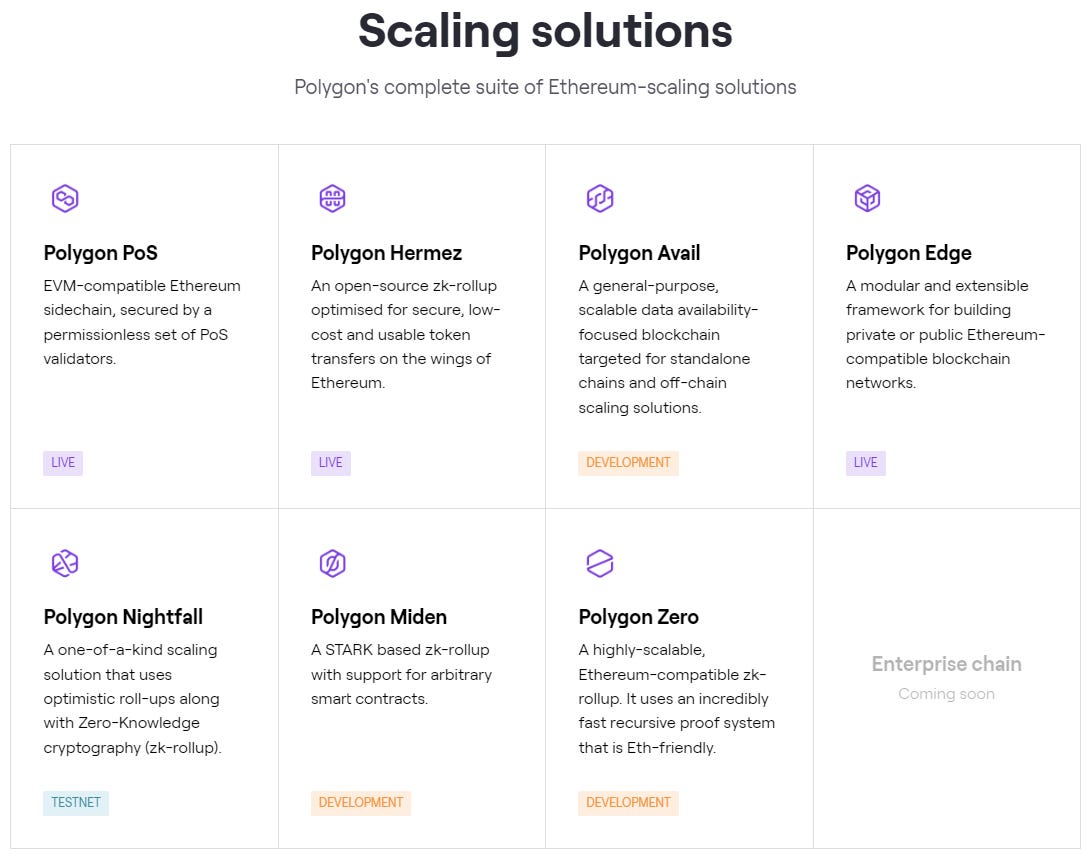

As mentioned before Polygon initially started by offering Plasma based scaling but now has a suite of solutions - which are all interoperable…

I’ll leave you to have a look at each one in turn but Polygon PoS is what most people think of when they think of Polygon - an L2 chain that hosts most projects.

This will be the chain we apply most of our analysis to later when thinking about active users, transactions & volume and developer ecosystem.

Polygon Hermez

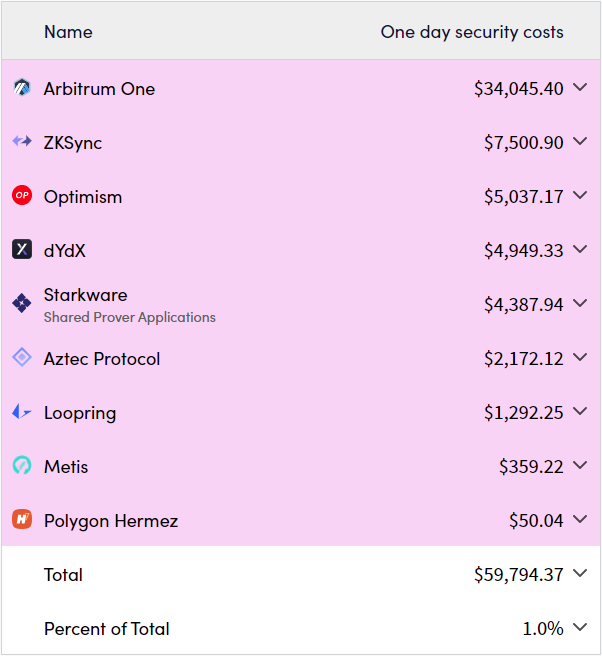

In terms of the improvements Polygon Hermez has bought to Ethereum this table shows the difference in fees for various L2’s:

To secure the transactions these rollups pay rent to Ethereum for its security:

As we can see, rollups do cost the chains money - but Polygon Hermez is under little stress.

1d) Polygon PoS

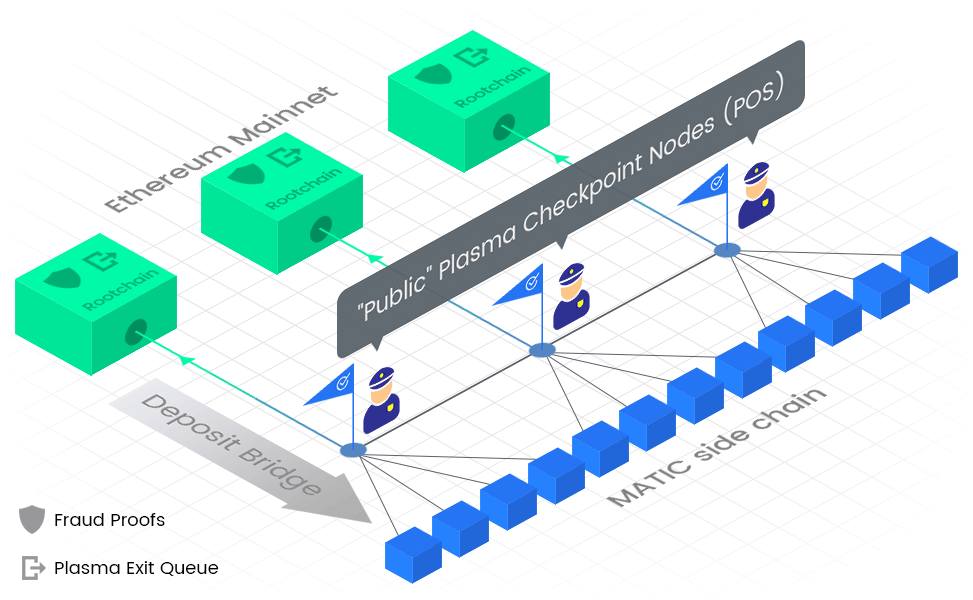

The Matic Network is split into 3 layers:

Staking and Plasma smart contracts on Ethereum

Heimdall (Proof of Stake validation layer)

Bor (Block producer layer)

Each one play an important role in the functioning of the chain and you can read more about each here. A way to visualise this is as follows:

Interestingly block producers are shuffled periodically by the Heimdall validators, which, as we saw with Harmony, may help to reduce attack vectors.

Transactions per second (TPS)

Polygon claims to have a theoretically max TPS of 65k however at the moment we are achieving just 40.83:

A blog from Oct 2021 by Jacobo stated that “independent tests have shown closer to 7,000 TPS even under a favourable setup”… so the team has still got a long way to go.

Time to finality (TTF)

TTF is super important - as your transaction doesn’t count until its in the blockchain. For Polygon this presents a bit of an issue as they have a fast TTF on their PoS chain but then have to wait for the information to be written into Ethereum.

In Mar 2022 @hosseeb calculated this to be 25 mins - which is slow compared to Alt-L1s like Avalanche which has TTF of 1.75s…

Part 1: Protocol Summary

In summary Polygon has a strong foundation, offering solutions for the various needs of their developer community, reduces the fees considerably and has a theoretically high TPS.

One item that may be largely unsolvable - although maybe in the long run if Ethereum becomes just a security chain/Eth2.0 scales better - is TTF, which lags behind Alt-L1s.

Part 2: Investors, Tokenomics and Validators

2a) Investment Rounds

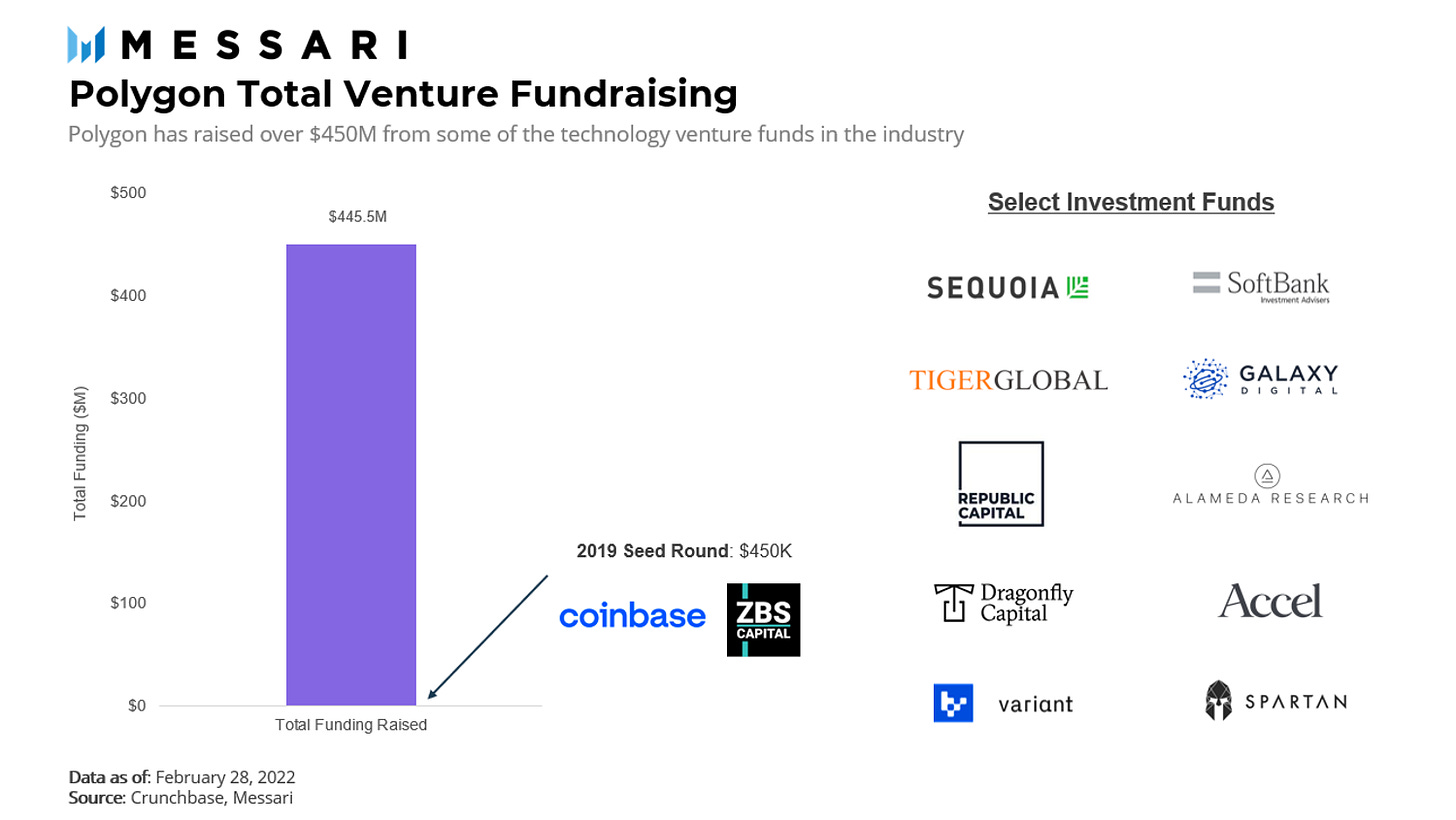

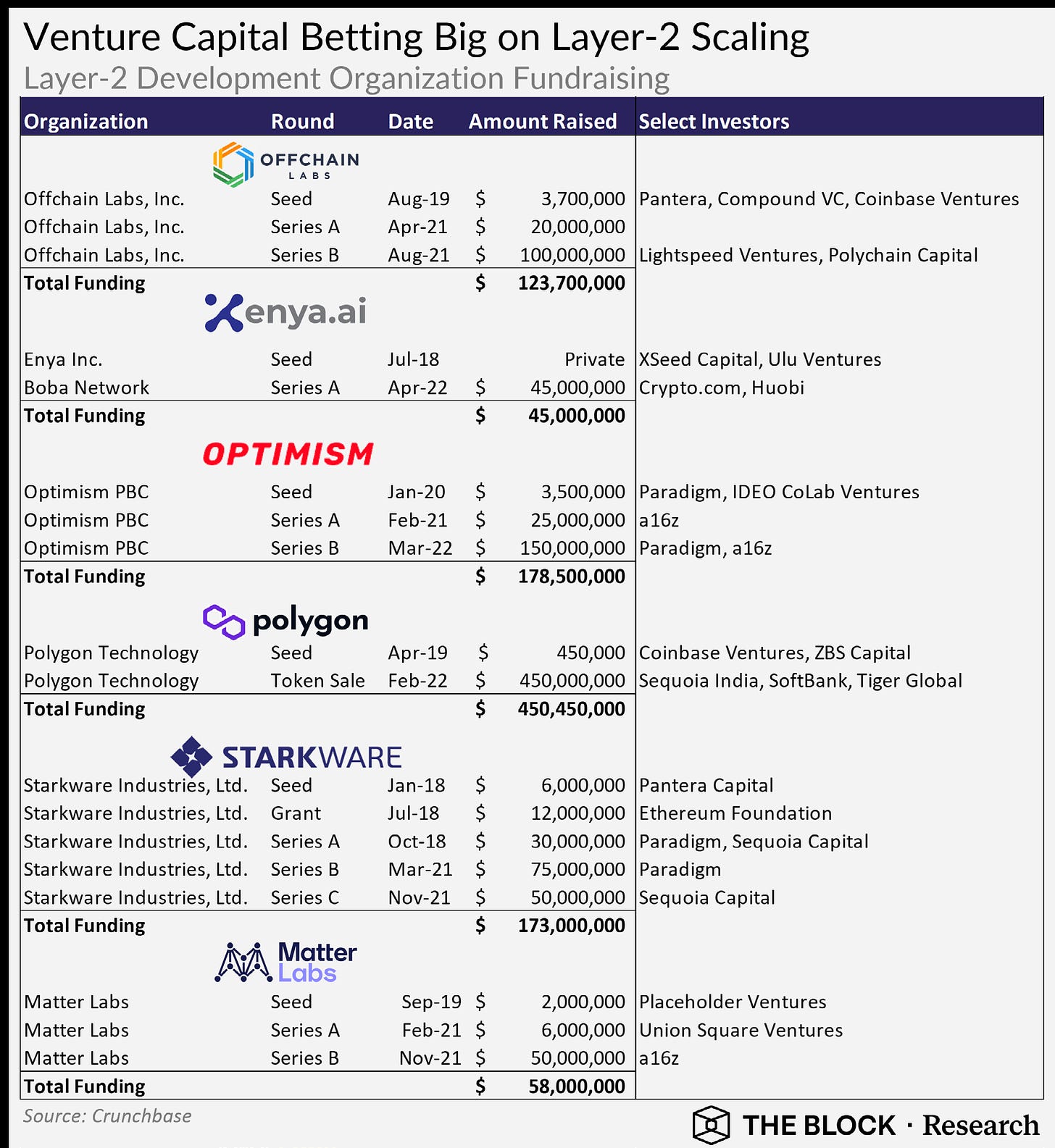

L2 solutions have raised a lot of money and Polygon leads:

According to Messari, this number is slightly different with Polygon raising just shy of $450M from top funds:

Having the likes of Softbank and Tiger makes Polygon extremely deep pocketed vs the rest of the space…

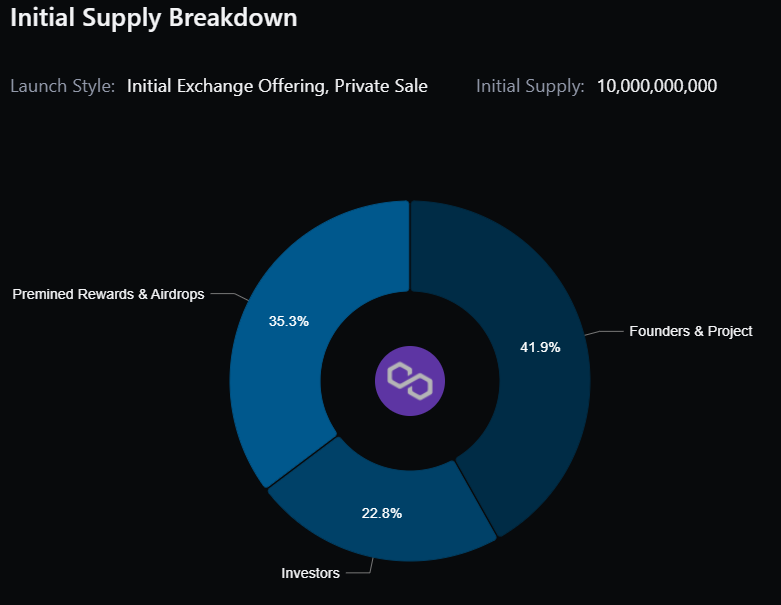

2b) Investor Token Allocation

Polygon’s initial supply is broken down as so:

Using the below data from Messari this seems in line with a lot of the newer chains (Near, Avalanche, Celo) that required VC funding.

2c) Tokenomics (Supply)

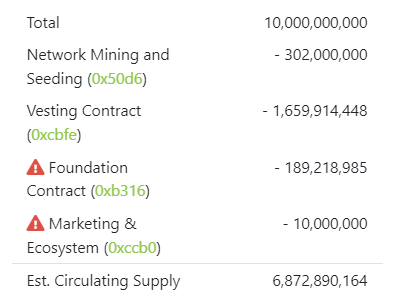

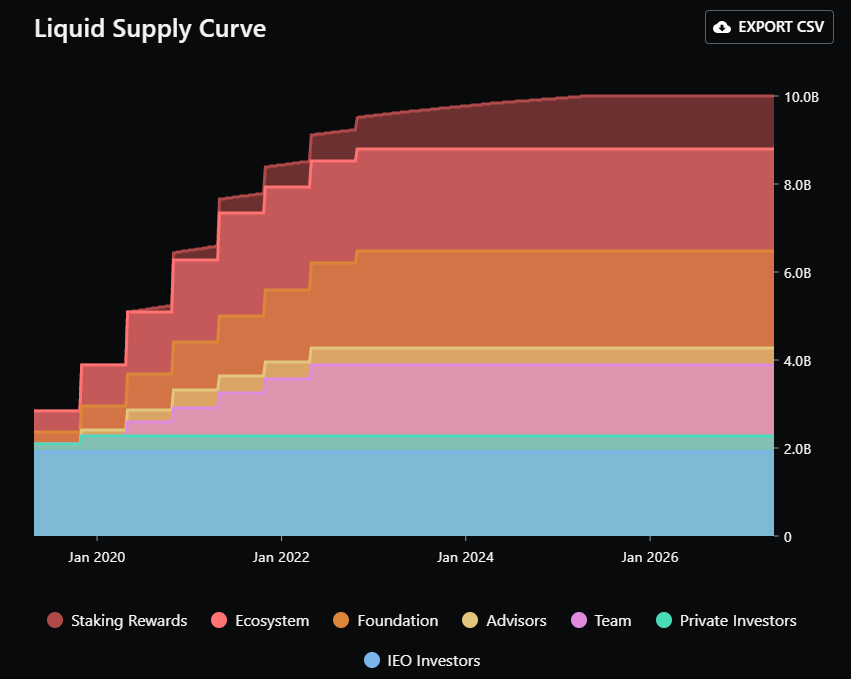

The max supply of Polygon is 10b with the current circulating supply at 6.87b according to CoinGecko this breaks down as so:

The release of the currently locked tokens is mapped by Messari:

Recently Polygon introduced a feature similar to EIP1559 where the base fee in every transaction. You can monitor the impact on PolygonBurn:

The team at Polygon modelled the annual impact of this mechanism and worked out a reduction of 0.27% annually of the total MATIC supply.

2d) Tokenomics (Demand)

As usual demand for MATIC tokens are in transaction fees, staking e.g. tokens get locked away, and governance.

Matic has allocated 12% of its total supply of 10 billion tokens to fund the staking rewards. This is to ensure that the network is seeded well enough until transaction fees gain traction. These rewards are primarily meant to jump-start the network. While the protocol in the long run is intended to sustain itself on the basis of transaction fees. ~ Polygon Docs

2e) Validators and Miners

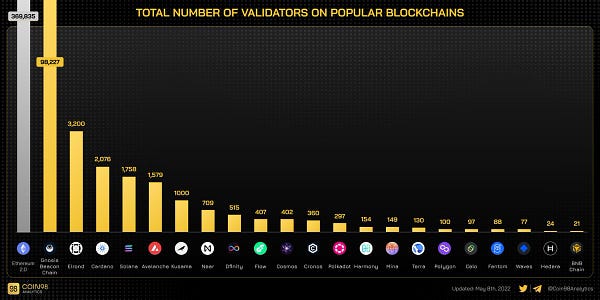

Polygon has 100 validator slots, with a minimum 1000 MATIC tokens posted as collateral in order to run a complete node on the network. Lockup of tokens is currently 21d and rewards around 6%.

With a marketcap of $4.4b and $1.83b staked, this shows a participation rate of 35% which is lower than some of the other chains we have looked at.

2f) Centralisation

Polygon has 100 validators currently, which is at the lower end of the spectrum:

Note: The Eth2.0 number is a bit misleading as explained in this reddit thread

I cannot find an updated stat but back in Aug 21 just 2 validators held enough voting power to stop the network:

Part 2 Investors, Tokenomics and Validators Summary

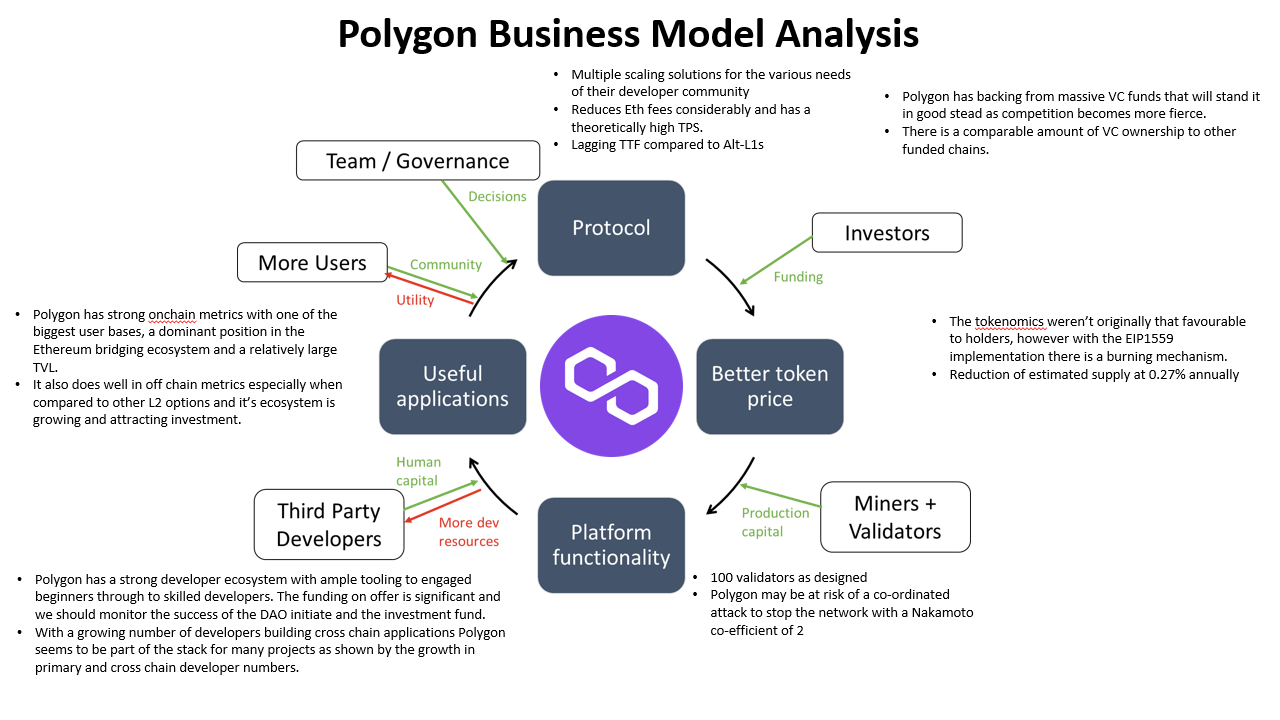

Polygon has backing from massive VC funds that will stand it in good stead as competition becomes more fierce. There is a comparable amount of VC ownership to other funded chains.

The tokenomics weren’t originally that favourable to holders, however with the EIP1559 implementation there is a burning mechanism now.

Polygon may be at risk of a co-ordinated attack to stop the network with a Nakamoto co-efficient of 2, however this may have changed…

Part 3: Developers

3a) Developer experience

Developers are still flocking to Polygon as it has a mature and robust support ecosystem via not only its own portal which offers extensive documentation,

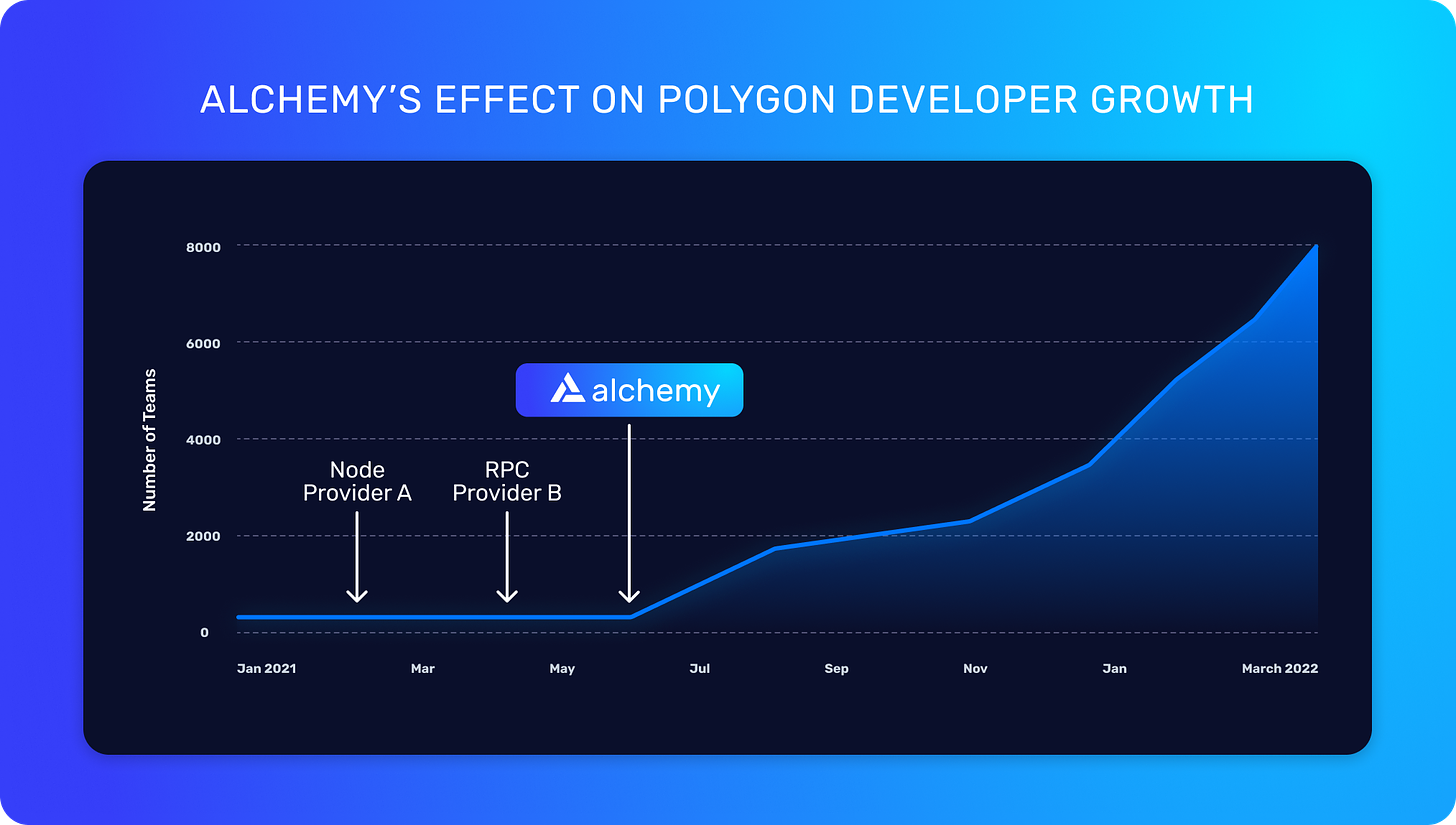

But also 3rd party developer tools like Decentology and Alchemy - the impact of which is summarised in this graph…

3b) Developer Growth

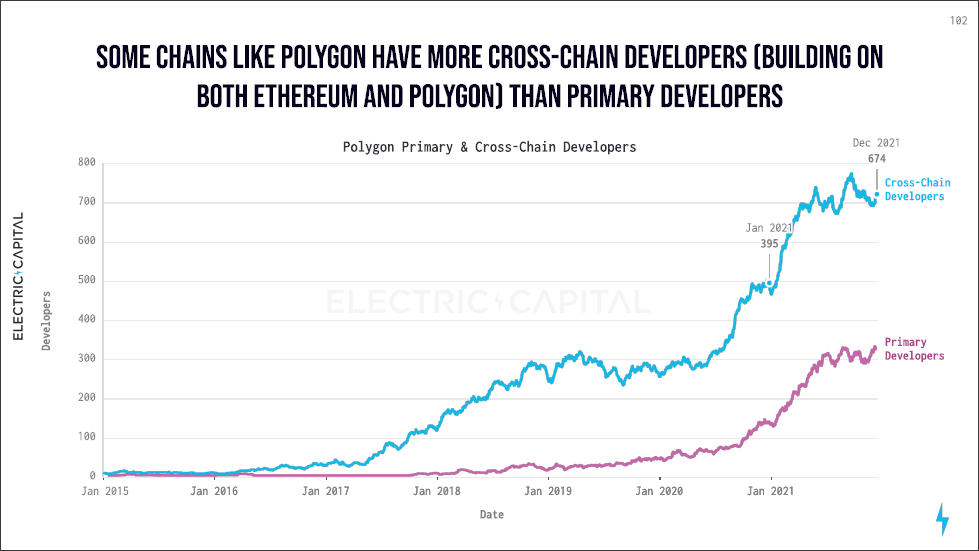

Electric Capital Developer Report (2021) shows Polygon doubled it’s monthly developers in 2020-2021:

While not the fastest growing chain on a normalised basis, it has more than 300 developers, which puts it ahead of many comparable chains:

In addition it is one of the fastest growing developer ecosystems:

However Polygon has a lot of cross chain developers rather than primary devs, which is largely to be expected with it’s emphasis on being an L2… But in my opinion at least, that may put it at risk of losing developers if tooling in the other ecosystems accelerates faster than Polygon’s offering.

3c) Available funding

Polygon has two major funding schemes; a normal investment vehicle and a DAO promoting community involvement:

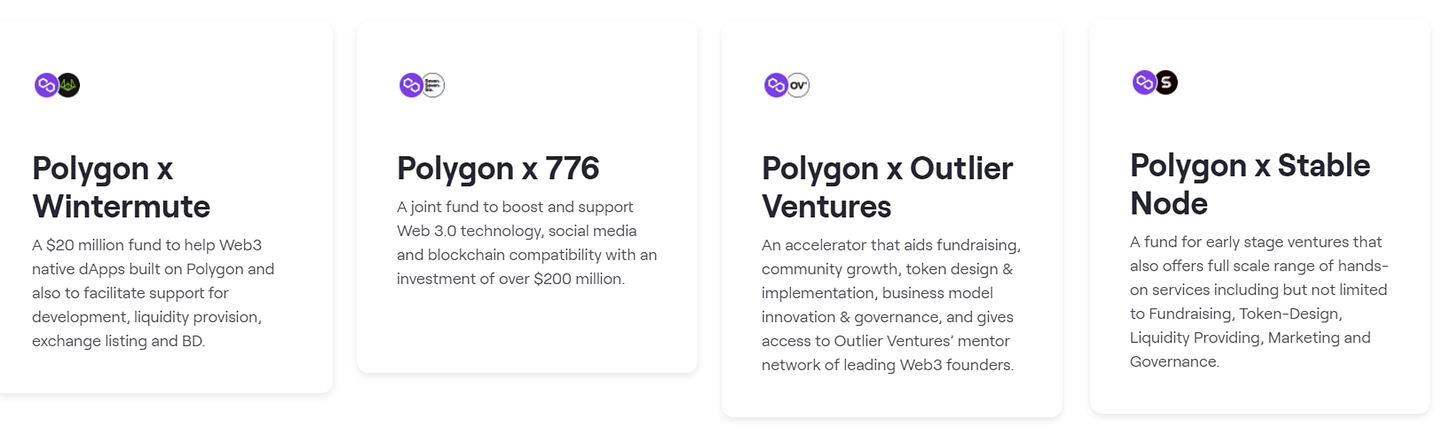

In addition they have 4 other funds in partnership with leading accelerators and VCs

By my count the overall ecosystem fund now sits somewhere around the $350m mark (although unconfirmed) which is large but the likes of Near ~$1b, XRPL ~$500m and others mean that anything under $500m is relatively small…

Part 3 Developer Experience Summary

Polygon has a strong developer ecosystem with ample tooling to engaged beginners through to skilled developers. The funding on offer is significant and we should monitor the success of the DAO initiate and the investment fund.

With a growing number of developers building cross chain applications Polygon seems to be part of the stack for many projects as shown by the growth in primary and cross chain developer numbers.

Part 4: Usage

4a) Onchain analysis

4a.i) Unique Addresses

Polygons active addresses have slowed their growth, now adding between 50-100k new addresses per day. Far slower than the nearly 2m a day in Sept 21

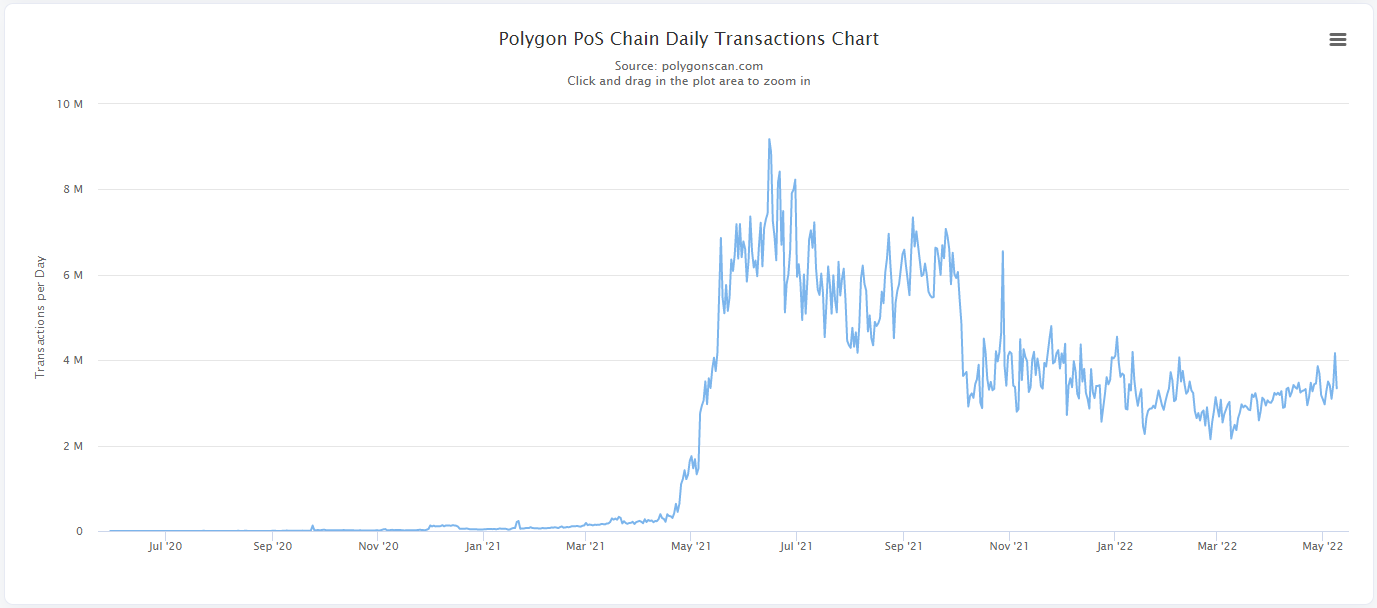

4a.ii) Daily transactions

Daily transactions have also settled between the 3-4M range.

Comparing these numbers to other chains we can see that Polygon is on par with some of the largest chains Ethereum (1M), BSC (4M), Avax (225K)

4a.iii) TVL

Polygon has the 6th largest TVL according to DeFi Llama representing 2.53% of the TVL for all chains:

Breaking down the TVL we can see that Polygon is far more diversified than Harmony with multiple chains contributing over $100M in TVL:

Bridging from Ethereum

One aspect of TVL will be bridged assets from Ethereum, Polygon.

Polygon bridges lead in this regard with over 30% of the market share.

The amount of volume through the bridge has remained relatively consistent and seen a much smaller drop off when compared to Arbitrum, Avalanche and Fantom during the recent sell off:

4b) Off Chain Metrics - Socials

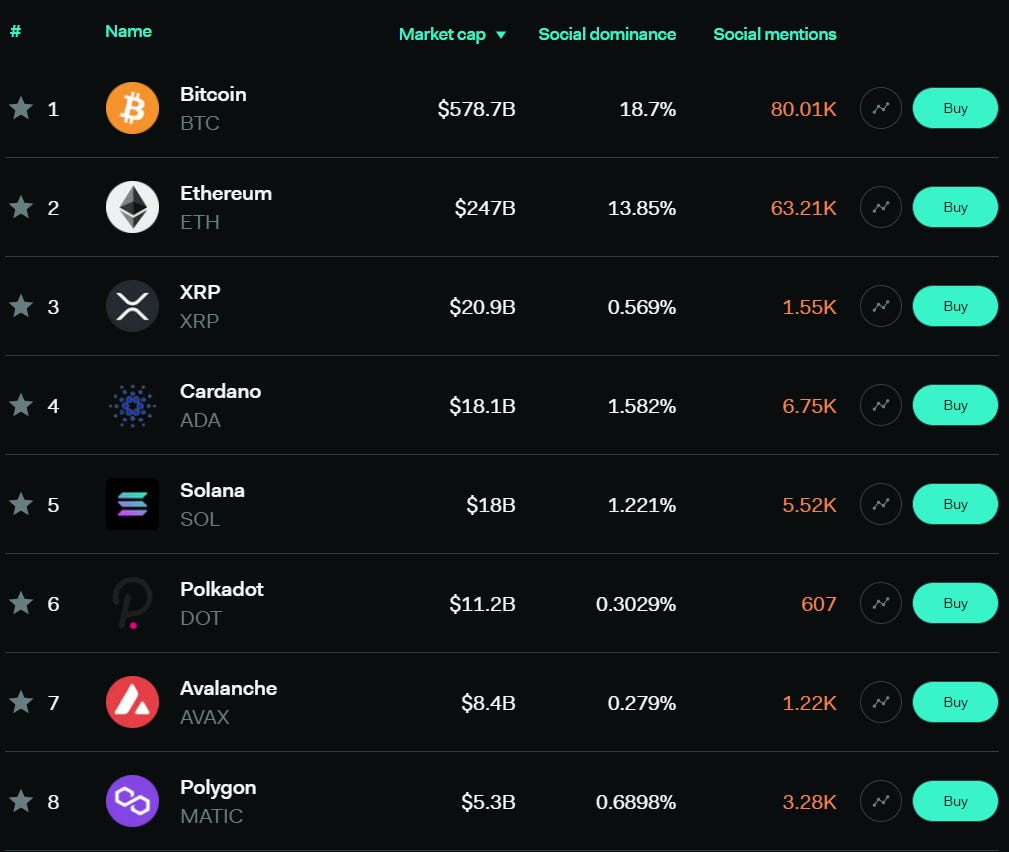

Compared to the largest coins Polygons off-chain statistics are favourable with a greater number of mentions than XRP, Polkadot and Avalanche:

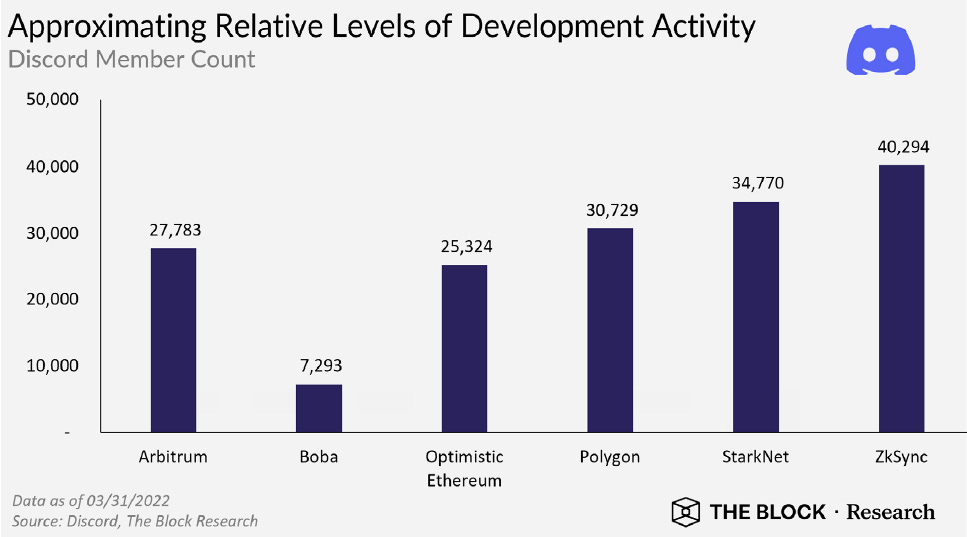

Polygon has one of the larger discord communities when looking at L2’s:

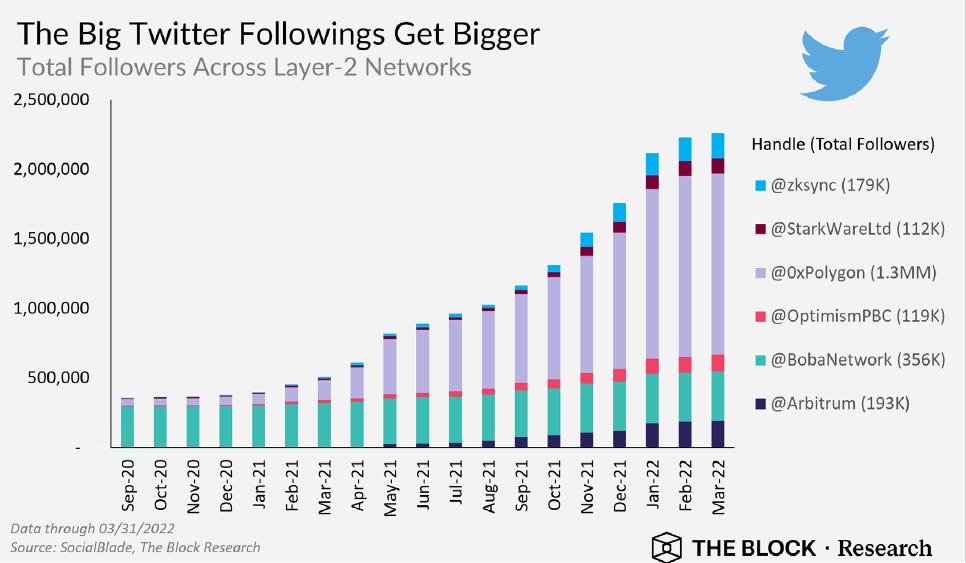

And by far the strongest Twitter following:

4c) dApp Ecosystem

Polygon claim to have over 19,000 dApps - DApp Radar puts this number at 1024, so I am interested to see what Polygon’s criteria for this, although the other stats on the dashboard are in line with our findings above.

In May 21 The Block compiled this map to show the ecosystem:

Both DeFi and NFT/Gaming protocols on Polygon seem to be attracting investments, and we can safely make the assumption that a lot of the “multi-chain” raises also covered Polygon in their tech stack

In terms of the number of dApps and how this compares to other ecosystems Polygon has 1024. This is larger than the numbers for Solana (76), Avalanche (297), and Fantom (243).

Part 4 dApps and Usage Summary

Polygon has strong onchain metrics with one of the biggest user bases, a dominant position in the Ethereum bridging ecosystem and a relatively large TVL.

It also does well in off chain metrics especially when compared to other L2 options and it’s ecosystem is growing and attracting investment.

Part 5: Team

5a) Team & Advisors

Polygon has a strong team of experienced people

Seedly did a great analysis of the Matic team so I will borrow their research:

Chief Executive Officer (CEO) Jaynti Kanani, a full-stack developer and blockchain engineer who worked on prominent blockchain projects like Web3, Plasma and WalletConnect.

Chief Operating Officer (COO) Sandeep Nailwal, a blockchain programmer and entrepreneur who also founded ScopeWeaver a blockchain consulting company.

Chief Product Officer (CPO) Anurag Arjun, who previously worked at SNL Financial, Dexter Consultancy, and Cognizant Technologies in a product management role.

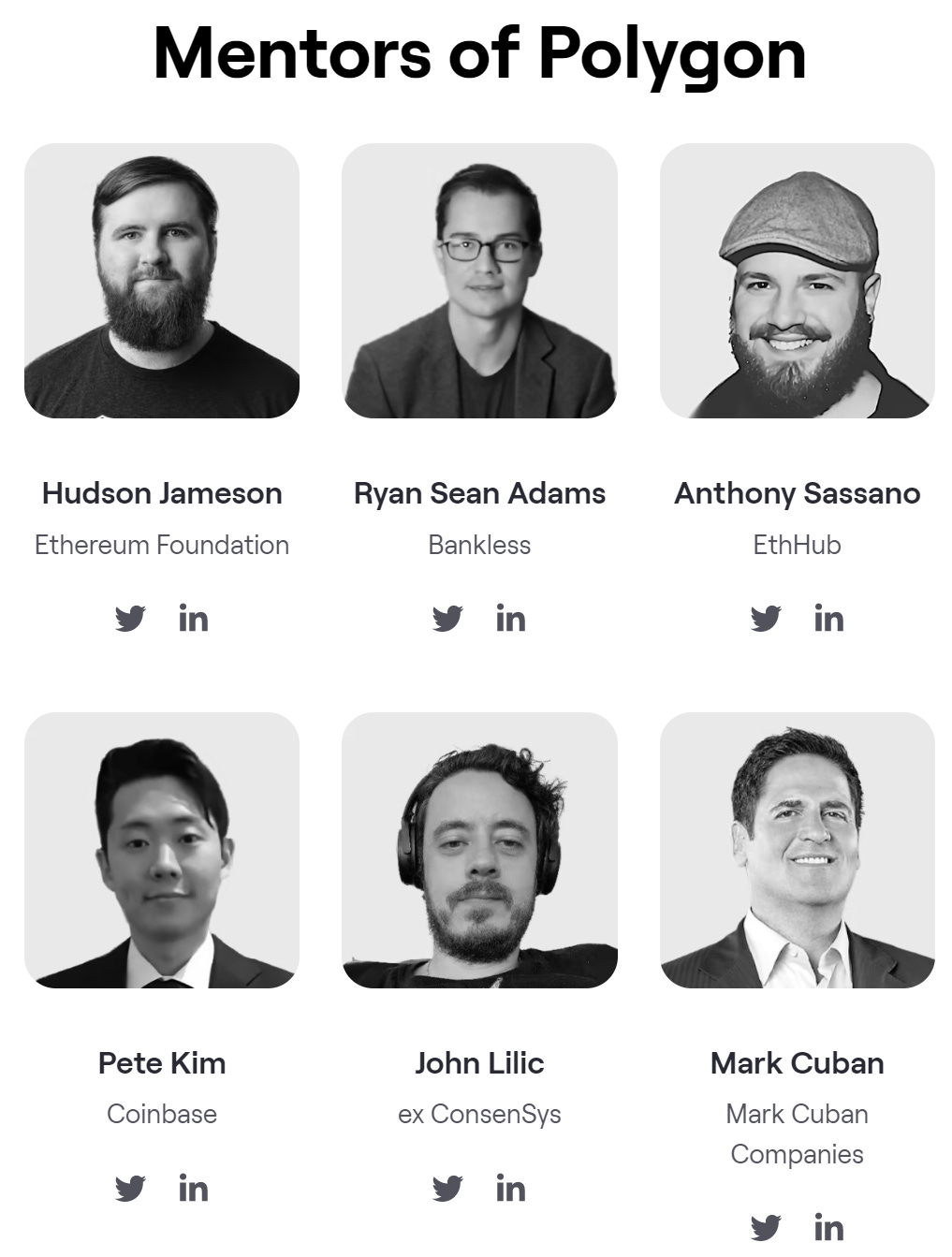

They also have a number of expert mentors include Mark Cuban; the famous billionaire…

5b) Governance

Polygon recently introduced snapshot as a way of voting on proposals:

The future thinking on governance was laid out in a post recently which I’ll leave you to read if you want more info.

Part 6: Closing Thoughts

This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for Polygon:

🐂 Bull Case

Polygon offers a great alternative to building on Ethereum, that has resulted in better user experiences for many dApps.

Backed by big funds and offering clear help to developers to get started quickly this will continue to attract great projects

The other solutions Polygon has developed eventually eclipse the smaller L2 offerings/acquires more (e.g. Hermez) and MATIC becomes the only way to scale Ethereum (apart from core upgrades) on the market.

Developer tools like Alchemy rapidly improve the DX on supported chains, bringing in more dApps and tools which attract further users to the ecosystem.

🐻 Bear case / headwinds

If Ethreums’s 2.0 upgrade delivers this will cut into Polygons ability to attract users for cheap transactions. However, it will likely still be many times faster.

Potentially in the v.long run more issues will arise from Ethereums upgrade but the Polygon team seem a lot more agile so far.

On the flip side if Ethereum continued to lose it’s TVL, as it had been doing prior to Terra’s collapse, then would Polygon have to become it’s own stand-alone chain?

TTF from polygon to becomes increasingly problematic for users . This will likely cause time sensitive dApps to be deployed on other L1 chains e.g. the biggest users of the current financial system are lighting fast arbitrage bots that require speed.

Conclusions

Having come into this research not knowing anything about L2s I have been consistently surprised at the traction they have.

Polygon leads in this area and so I will be following it’s development.

I still need to do further research on the risk that Ethereum somehow nerfs the alternative scaling solutions with it’s own development, but that does seem unlikely given the speed of Eth 2.0’s upgrade.

Team & community & projects accounts you may want to follow: @0xpolygon, @0xPolygonZero, @polygonstudios, @Fwiz, @shreyansh_27, @0xPolygonDAO, @0xPolygonMiden, @0xPolygonNF, @0xPolygonAvail, @0xPolygonID, @0xPolygonHermez, @0xPolygonEdge, @0xPolygonDevs, @0xPolygonNews, @QuickswapDEX, @NarbTrading, @amartyahari, @polygonscan, @polylauncher, @0xNicky, @inquisitivekath, @_khanhamzah, @0xPolystarter

FIN

As always DYOR this is not investment advice, also I might have missed stuff that is a key technology thing that you may understand better than I do.

Thanks for reading Altcoin Evolution by 0xGregH! Subscribe for free to receive new posts and support my work.